42+ is mortgage insurance tax deductible 2022

Ad Ask a Tax Expert About Tax Deductible Limits. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

The Florida Horse June July 2022 Farm Service Directory By Florida Equine Publications Issuu

Prior tax years.

. Web It depends. The PMI deduction is reduced by 10 percent for each 1000 a filers income. With all of the media publishing articles about the tax reform it is.

Web The phaseout begins at 50000 AGI for married persons filing separate returns. 109000 54500 if married filing separately The mortgage insurance premium. To deduct indirect expenses you need to calculate the percentage of your home that your.

Lets look at an example. Web The tax deduction was scheduled to last through the 2016 tax year but it has been extended through at least 2021. Even private mortgage insurance premiums which used to be.

Web Is mortgage interest tax deductible. Ad Learn How Simple Filing Taxes Can Be. Web They include mortgage payments property taxes utilities and homeowners insurance.

Web Mortgage interest. Mortgage around 200000 this means your PMI costs can range from 1000 to 4000 annually on top of your mortgage homeowners. File Online or In-Person Today.

Web No its not in fact no insurance-premium costs for your home can currently be deducted. Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals. Connect Online Anytime for Instant Info.

Web Many home buyers are wondering if private mortgage insurance or PMI is still tax deductible in 2022. Ad Taxes Can Be Complex. But for loans taken out from.

However higher limitations 1 million 500000 if married. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Homeowners who bought houses before December 16.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. TurboTax Has Your Back. That means that the tax return you file in 2022.

Imagine that your AGI for the taxable. Web Homeowners who have sufficient mortgage interest and other qualified expenses to get above the standard deductions of 25900 married filing jointly or. Mortgage Insurance Premiums you paid for a home where the loan was secured by your first or.

Web For 2022 the standard deduction for a single taxpayer is 12950 and 25900 for joint filers. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. Discover How HR Block Makes It Easier to File Your Way.

Get Online Answers in Minutes. Web 100000 50000 if married filing separately Eliminated if your AGI is more than one of these. Web Tax laws state that you may deduct up to 10000 5000 if married and filing separately of property taxes in combination with state and local income or sales.

Start Today to File Your Return with HR Block. However the insurance contract must. Web And with the average US.

The standard deduction is 19400 for those filing as head of. Let Us Find The Credits Deductions You Deserve. Web The PMI Deduction will not been extended to tax year 2022.

You can deduct amounts you paid for qualified mortgage insurance premiums on a reverse mortgage. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Ask a Verified Tax Accountant How Tax Deductibles Work.

Free 10 Mileage Log Samples In Pdf

:max_bytes(150000):strip_icc()/TaxDeductibleInterest-10de394cbe27459ebb6f979a8f795083.jpeg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

Rowan Senior Savvy December 2022 By Great American Publishing Issuu

Mortgage Interest Deduction How It Calculate Tax Savings

Is Pmi Mortgage Insurance Tax Deductible In 2022 Refiguide Org Home Loans Mortgage Lenders Near Me

Is Private Mortgage Insurance Pmi Tax Deductible

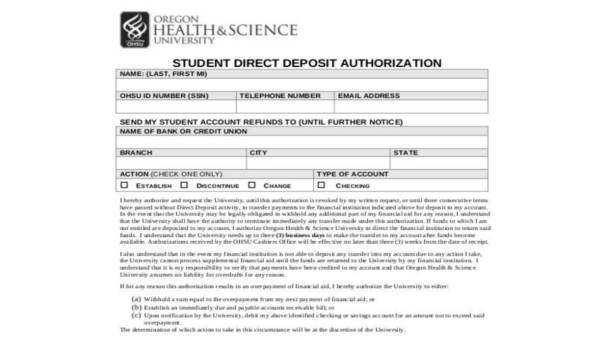

Free 42 Blank Authorization Forms In Pdf Excel Ms Word

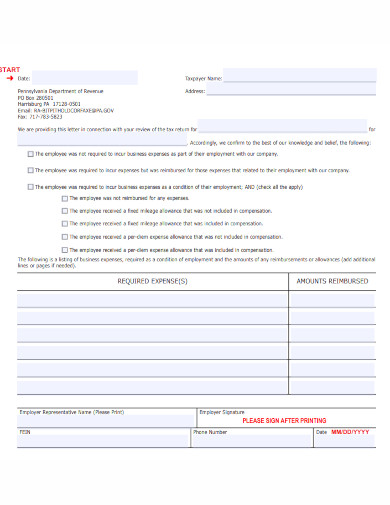

Tax Deduction Examples Pdf Examples

Pdf Labor Supply Effects Of Social Insurance

Mortgage Interest Deduction How It Works In 2022 Wsj

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Are Your Mortgage Payments Tax Deductible In 2022

33rd Ward Newsletter July 8 2022 Rossana Rodriguez

Ca Maneet Pal Singh On Linkedin My Quote In The Hindu Businessline On Recent Change In Ibbi

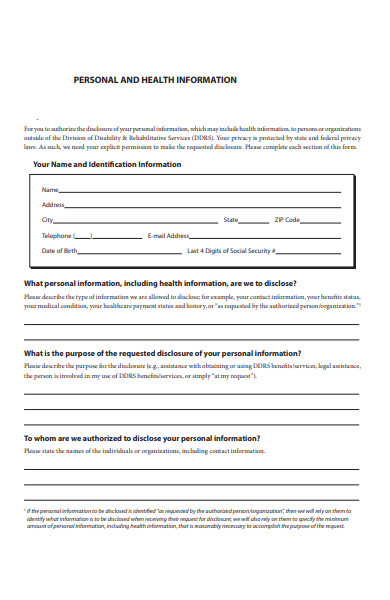

Free 42 Personal Forms In Pdf Ms Word Excel